How to Get Your Business On Shark Tank

Shark Tank is idolized in the startup world as the angel investor a brilliant but under-appreciated business deserves. Many entrepreneurs think their business is the next big thing (after all that’s why they started), so many in fact that Shark Tank receives over 45,000 applications a year. But out of those applications, only 200 get […]

Growth Capital Vs Working Capital

Growth capital and working capital can be simplified as long term and short term cash. Each has its own strategies for obtaining and sustaining, and each is important for the health of a business. Business capital is necessary to pay vendors and employees as well as investing in tangible assets that stimulate growth. It’s not […]

How To Use Bridge Funding

Bridge funding has several different meanings depending on the industry. In real estate, bridge funding is a downpayment in the form of a loan that home buyers often use when they’re waiting for their old home to sell but are already buying a new one. In the startup world, bridge funding is a small, short term amount […]

SBA Loans vs. FundKite Funding

When it comes to finding funding for your small business, there are countless options to explore. Two of the most enticing choices are often Small Business Administration loans and FundKite funding. FundKite is part of a new industry of financing companies that make it easier than ever for small businesses to acquire working capital, even the ones […]

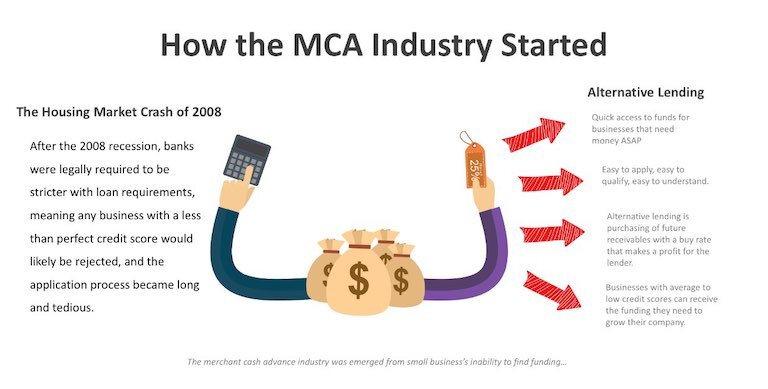

How The Alternative Lending Industry Began

1-877-502-5003 The alternative lending industry stupefies many business owners just beginning their search for funding. Part of the confusion comes from the industry’s polyonymous history and similar but shady associated industries. Alternative forms of money lending that were once referred to as payday loans, cash advances, merchant cash advance (MCA), and more, are now finding […]

Going Public With Your Company Pros & Cons

While the frequency of IPOs (Initial Public Offerings) has declined in recent years, the idea of going public can still be very seductive. To give an abridged version of a sixty-page paper available via Harvard, growth in the private equity market and improved access to capital have made it easier for private companies to stay private. Whether […]