Flexible Business Funding to Fuel Your Growth Now

Empowering Small Businesses since 2015

Running a business means navigating opportunity and uncertainty—often at the same time. Whether you’re scaling operations, stabilizing cashflow, or investing in new resources, reliable access to capital is one of the most powerful tools you can have. FundKite provides flexible business funding designed for entrepreneurs who need speed, transparency, and repayment structures that adapt to real-world operations.

With fast approvals, next-day funding, and revenue-based repayment, FundKite helps businesses across the country grow confidently without getting slowed down by traditional lending barriers.

Approvals in as Little as

Speak to Funding Expert:

Flexible Business Funding to Fuel Your Growth Now

Empowering Small Businesses since 2015

Running a business means navigating opportunity and uncertainty—often at the same time. Whether you’re scaling operations, stabilizing cashflow, or investing in new resources, reliable access to capital is one of the most powerful tools you can have. FundKite provides flexible business funding designed for entrepreneurs who need speed, transparency, and repayment structures that adapt to real-world operations.

With fast approvals, next-day funding, and revenue-based repayment, FundKite helps businesses across the country grow confidently without getting slowed down by traditional lending barriers.

Approvals as Fast as

Better Business Bureau

Speak to Funding Expert:

Why FundKite?

Because Payments Should be Flexible.

Why FundKite?

Because Payments Should be Flexible.

FundKite offers a repayment plan based on a percentage of the business’s Gross Sales, until fully repaid.

No minimum payment.

Payments are based on sales, offering protection during slower periods or when no sales occur.

200,000+

300+ Industries

Working Capital

Common Small Business Uses

- Boost Cash Flow

- Support Business Growth

- Cover Operational Costs

- Handle Emergencies

- Purchase Inventory

- Payroll Management

- Purchase Equipment

- Business Debt Consolidation

Easy Qualification

Our straightforward approval process is designed with a business owner's demanding schedule in mind.

Funding

We fully understand you need funding, and you need it now!

Direct Funder

By dealing with the source of capital and the decision-makers directly, you cut out unnecessary encumbrances-not to mention any extra fees.

Custom Funding Solution

Every business is unique, and so are its needs. We tailor our funding solutions to match your specific business needs.

How Our Business Funding Works

Submit a quick application—it takes just minutes.

Most businesses receive approval in as little as 4 hours.

Business Documents

Access up to $2 million within 24-48 hours.

Repay Flexibly

Whether you’re launching a new product, covering payroll, or buying inventory, FundKite’s business solutions make it happen fast.

Want a closer look at the process? Visit our How It Works page for details.

This streamlined fund-and-grow model is ideal for businesses that cannot afford long approval cycles or fixed monthly payments. With revenue-based repayment, you’ll never be trapped by high fixed obligations during slower seasons—your repayment simply moves with your business.

Highly Recommended!

Daniel Ameer

Adaptive Capital Corporation

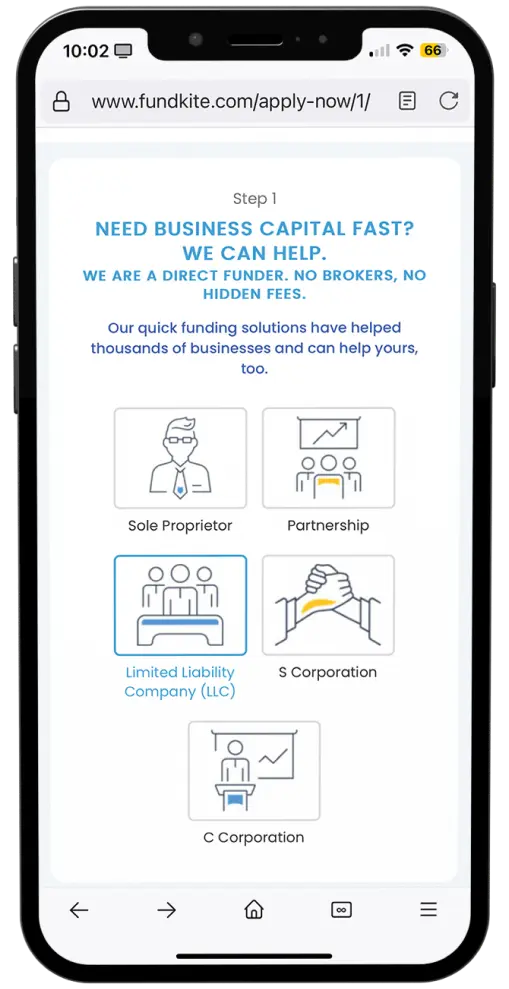

Who Qualifies for Business Funding

FundKite works with a wide range of industries and business types. To qualify, you generally need:

If that’s you, you’re already eligible for fast approval.

This inclusive approach makes FundKite a strong alternative for small and midsize companies who may struggle to secure traditional business loans from banks or credit unions.

Speak to Funding Expert:

Fast Business Funding for Ongoing Needs

If you require quick access to capital that aligns with your operational cash flow instead of rigid traditional financing, FundKite offers Revenue-Based Financing, noting that our products are purchases of account receivables and are not business loans. FundKite provides tailored funding options with a repayment model that adjusts according to your business’s revenue, ensuring payments decrease during slower periods and increase during busier times so that you never face undue financial strain. FundKite’s fast, flexible funding solutions, with funds available within 24-48 hours after final approval, give you the flexibility to:

Handle unexpected expenses

Manage seasonal cashflow fluctuations

Fund marketing or equipment purchases

Cover short-term vendor or staffing costs

Our quick funding approvals mean you can access working capital instantly—no waiting, no stress.

This is especially useful for businesses with variable operating expenses, such as restaurants, retail stores, construction companies, e-commerce brands, and professional service organizations.

Have questions about eligibility or limits? Check out our FAQs page.

Speak to Funding Expert:

Why Choose FundKite for Business Funding

Approvals in as little as 4-Hours

24-48 Hour Funding

get cash when you need it

Revenue-Based Repayment

Credit scores

Up to $2 million available

Speak to Funding Expert:

Loan Alternatives with Fast Business Funding Made Simple

Every business hits moments where growth or cashflow depends on quick access to capital. FundKite’s solutions give you that speed—with approvals in as little as 4 hours and funding in 24-48 hours.

Unlike banks that bury you in paperwork, we deliver business loan alternatives based on your revenue, not just your credit score. You get the cash you need without sacrificing flexibility or control. Fast funding is essential for:

FundKite streamlines the entire process so business owners can focus on strategy, customers, and growth—not paperwork.

Speak to Funding Expert:

Covering payroll during slow sales cycles

Taking advantage of limited-time opportunities

Purchasing inventory in bulk

Launching new marketing campaigns

Handling unexpected vendor or equipment expenses

Loan Alternatives with Fast Business Funding Made Simple

Every business hits moments where growth or cashflow depends on quick access to capital. FundKite’s solutions give you that speed—with approvals in as little as 4 hours and funding in 24-48 hours.

Unlike banks that bury you in paperwork, we deliver business loan alternatives based on your revenue, not just your credit score. You get the cash you need without sacrificing flexibility or control. Fast funding is essential for:

Covering payroll during slow sales cycles

Taking advantage of limited-time opportunities

Purchasing inventory in bulk

Launching new marketing campaigns

Handling unexpected vendor or equipment expenses

Speak to Funding Expert:

Small Business Funding - The FundKite Difference

FundKite

-

Funding Amount

$10K - $2M -

Funding Process

Submit application and bank statements, if qualified review and accept offer, submit business documents -

Approval Time

As fast as 24 hours or less -

Funding Time

24-48 Hours of approval -

Minimum Approval Criteria

1 Year in business, business bank account, $10K/month gross deposits, 5+ deposits per month

Bank Loans

-

Funding Amount

$10K – 2M Continuing tightening credit standards make approvals difficult -

Funding Process

Application, hard credit check, business plan, tax returns, P&L, financial statement -

Approval Time

1 Week - 1 Month -

Funding Time

Additional 1-2 weeks after approval -

Minimum Approval Criteria

Personal and business credit score, 2+ years time in business, $100-200K min. annual revenue, 50% or lower debt to income ratio, collateral, business plan, personal and business financial statement, legal documentation.

SBA Loans

-

Funding Amount

Depends on credit -

Funding Process

Lengthy application process,

industry risk, credit inspection

& business plan -

Approval Time

Weeks - Months -

Funding Time

2 - 3 Months -

Minimum Approval Criteria

Credit score & collateral

Credit Cards

-

Funding Amount

Depends on credit -

Funding Process

Pre-qualify online,

soft credit pull -

Approval Time

Under 30 Days -

Funding Time

7-14 Business

Days -

Minimum Approval Criteria

Credit score

Speak to Funding Expert:

National Funding for Local Businesses

FundKite supports companies across the U.S.—from local startups to multi-location operations. Our products are designed to keep your business competitive in any market.

We’ve helped thousands of business owners expand locations, hire staff, and invest in growth without traditional loan delays.

From small town service providers to large metro retailers, FundKite’s national reach ensures businesses receive personalized support backed by industry expertise and a proven process.

Revenue-Based Repayment That Fits Your Business

Your repayment is tied to a percentage of your sales—pay more when you earn more, less when business slows.

This keeps your cashflow steady and protects you from over-committing to high fixed payments. Revenue-based repayment is ideal for businesses experiencing seasonal cycles, fluctuating customer volume, or unexpected changes in operating expenses.

Rather than risking financial strain, FundKite helps you maintain stability while pursuing growth.

Speak to Funding Expert:

Start Your Business Funding Journey Today

FundKite is the trusted partner for businesses that value speed and flexibility. Get approved in hours, funded within a day, and gain a financing plan that grows with you.

Approvals in as little as 4 hours

Funding within 24-48 hours

No credit impact to apply

Frequently Asked Questions About Loan Alternatives and Business Funding

Everything you need to know about payroll funding solutions

What is business funding?

Do I need good credit to qualify?

Are there hidden fees?

Will applying affect my credit score?

What industries does FundKite fund?

How fast can I receive the funds?

What can I use business funding for?

Businesses commonly use funding for:

- Payroll

- Inventory

- Marketing and advertising

- Expansion

- Emergency expenses

- Renovations

- New product launches

- Technology upgrades

What is revenue-based repayment?

Is this considered national funding?

Fundkite does not offer loans, it provides revenue based Financing, based on your business gross sales